by Correspondent

“We do not have to accept the ‘new mediocre’ of anemic growth”-

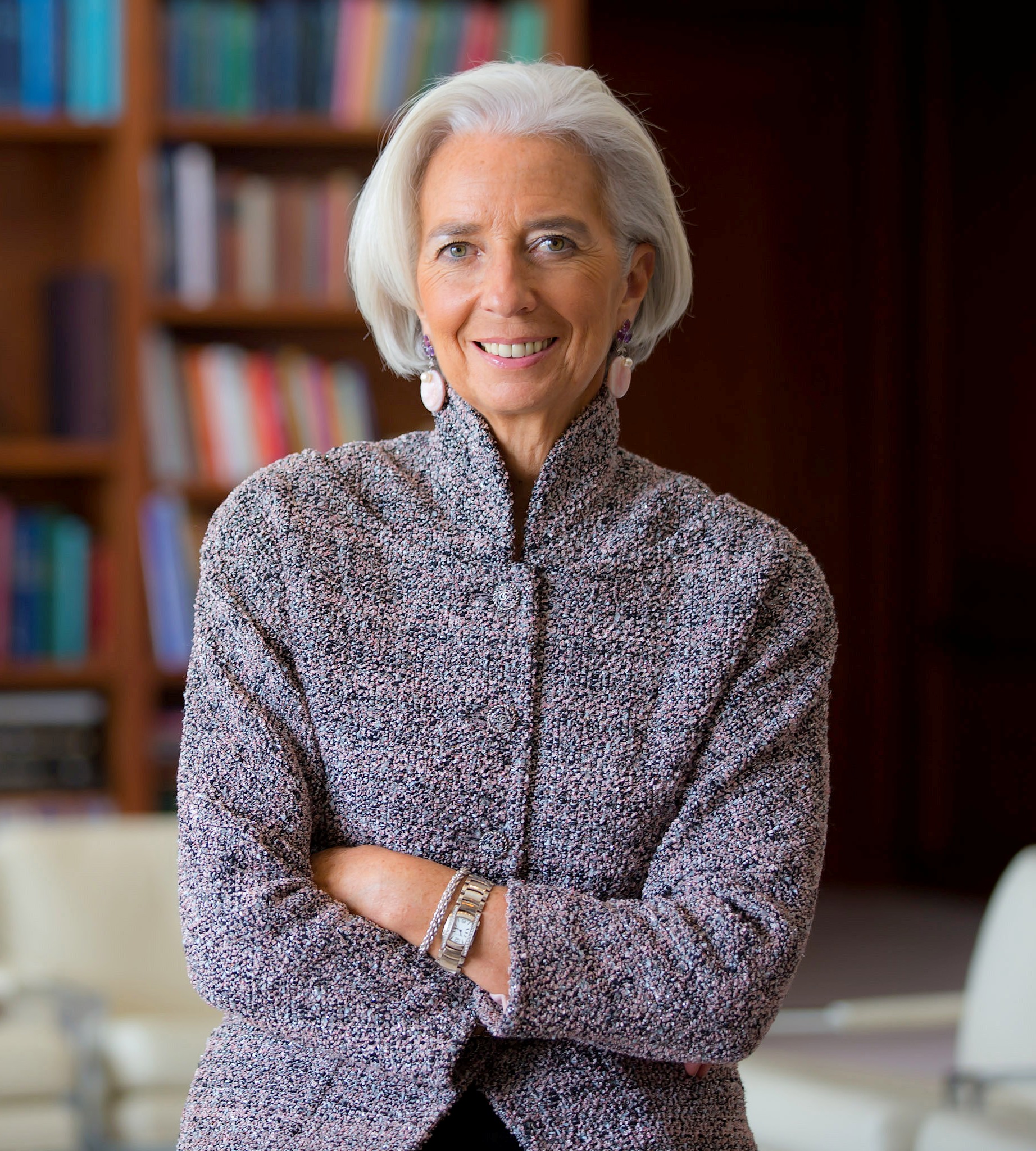

Christine Lagarde, Managing Director, IMF

Inclusive financing, as it is often referred to, involves the delivery of financial services at affordable costs to sections of disadvantaged and low-income segments of society.

It is regarded as such a significant economic enabler that many acclaimed economists praise its potential to reduce poverty and boost prosperity in nations around the world.

The importance of financial inclusion was recently acknowledged by an international conference which was jointly organized by the International Monetary Fund (IMF) and the Center for Global Development (CDG).

In fact, the CGD launched a vital report on how to deal with regulatory challenges that impede financial inclusion, an area that is of deep interest to almost all nations.

Relevance today

According to Christine Lagarde, IMF’s Managing Director, financial inclusion is distinctly moving up the reform agenda, both at the international level and in individual countries.

She opined during the conference that the post-2015 Development Agenda squarely puts financial inclusion as a key objective for United Nations member countries.

The Managing Director asserts that to date, more than 60 governments across the world have set financial inclusion as a formal target.

“And we know why these governments support this. The balance of evidence from micro-level studies is clear. Greater access to financial services makes a difference in investment, food security, health outcomes, and other aspects of daily life,” expressed Lagarde.

But today, the former Finance Minister of France contends that leaders of the world are asking whether financial inclusion is actually macro-relevant. The question she noted is one that is often placed alongside the perception that when it comes to improving individuals’ lives, one may be tempted to doubt the power of financial inclusion and whether it makes a significant impact at the country level, or even at the global level.

The Managing Director said that leaders may even consider that if financial inclusion has an impact, then the logical follow up question may be, “What are the trade-offs and synergies of financial inclusion when it comes to balancing growth and stability?”

She said, too, that leaders may also inquire if financial inclusion leads to “too much finance?”

To answer these questions, Lagarde posits that leaders need to look into data that provide evidence on macroeconomic effects of financial inclusion.

She noted that this can be found at the IMF. She said that the IMF’s Financial Access Survey, launched in 2009, is a key source of data on access to and use of financial services around the world.

The survey covers 189 countries for 11 years, providing a unique set of high-quality, publicly available data on financial inclusion.

Trends

Lagarde asserts that much can be learnt from this treasure trove of data.

The former Finance Minister of France said, “For example, the survey shows that there are 15 economies in Sub-Saharan Africa where the number of mobile money accounts exceeds the number of depositors in commercial banks. We also know that deposit accounts at commercial banks in India have grown by half a billion over the past five years.”

The Managing Director continued, “These are astounding figures, which illustrate the rapid evolution of financial access, especially in emerging markets and low-income economies. Many of these achievements are due to concerted policy efforts.”

She said that in India’s case, for example, the government has turned financial inclusion into a key national priority to curb inequality and boost domestic growth. Lagarde said that their agenda envisages universal access to basic banking services by 2018. She said that this is a commendable effort.

Macroeconomic benefits

The IMF’s Managing Director noted that the macroeconomic benefits of financial inclusion are indeed many. To support this claim, she cited a recent analysis by the IMF staff which examined the issue using the newly available global datasets.

Lagarde said, “It found that greater financial inclusion has tangible economic benefits, such as higher GDP growth and lower income inequality. By providing access to accounts, credit, infrastructure, women and low income users, financial inclusion helps make growth more inclusive.”

As it relates to questions of financial stability, Lagarde stated that the study finds no evidence that financial stability is threatened by increasing basic access to financial transactions, such as receiving wages and subsidies or making payments. She noted however that financial stability risks can arise when it comes to broadening access to credit to a wide section of the population.

Even in this situation, she said that there is hope and good news. Using information on supervisory quality in about 100 countries from the Financial Sector Assessment Program, the Managing Director revealed that one finds that when supervision is of high quality, broadening credit access actually leads to an increase in financial stability.

“So, good supervision can play an important role in promoting financial stability even as access to credit reaches a broader population, raising growth rates and reducing inequality,” Lagarde noted.

New technologies

Along with supervision, the Managing Director of the IMF noted that a solid enabling regulatory environment is also critical for promoting innovative financial services that reaches large segments of the population.

The former Finance Minister said that new technologies, especially those driving digital finance, provide immense opportunities for connecting businesses across the world.

Lagarde said, “Think of a farming cooperative in Bangladesh that sells rice at the highest price to an industrialist in Chile, without any middlemen. But digital finance must go hand-in-hand with advancing financial education and preventing cyber fraud.”

Despite clear evidence of its benefits to individuals and society as a whole, Lagarde posits that financial inclusion is often proceeding on an isolated track—more social policy than macro policy.

She believes that it is critical that nations avoid such a “silo mentality.” The Managing Director of IMF asserted that financial inclusion is an integral part of inclusive growth strategies and should be closely integrated into macroeconomic and financial policies.

Lagarde said, too, that when financial systems become more inclusive, they help broaden financial markets and make monetary policy more effective. By bringing more sections of the population into the formal sector, she expressed that the effects of fiscal policy—both tax and expenditures—are broadened.

Importantly, Lagarde noted that just as growth is slowing down around the world, promoting financial inclusion will go a long way in raising demand—as incomes of the low income population increase and the hollowing out of the middle class is arrested.

She emphasized, “We do not have to accept the ‘new mediocre’ of anemic growth.”