Rum producers rage against moves by C’bbean Private Sector to increase taxes on imported glass bottles

Guyanese Producers are challenging a request by the Caribbean Private Sector Organisation (CPSO) to increase the taxes on imported glass packaging from outside of the region which could result in a possible increase in prices for all glass bottled products such as rum and food ingredients.

An article published by the Barbados Advocate on December 15, 2022, stated the change could make importing glass bottles more expensive. Rum producers belonging to the West Indies Rum and Spirits Producers Association (WIRSPA) met to discuss this and other issues affecting the industry.

“We’re concerned that the move to increase taxes will facilitate the formation of a monopoly situation where the supply of bottles to the market with be controlled by the sole regional supplier of glass bottles. There is a real danger that for export products, this could cause a relocation of value-added bottling operations overseas and the loss of regional jobs,” Komal Samaroo, the Chairman of WIRSPA and head of the Demerara Distillers Limited (DDL) was quoted as saying in the article.

Samaroo added, “The irony of this proposal is that we as an industry are already buying all the glass packaging the Trinidad-based regional supplier is able to supply, and several producers have had to resort to importing glass because the supplier cannot meet demands, or because of quality problems.”

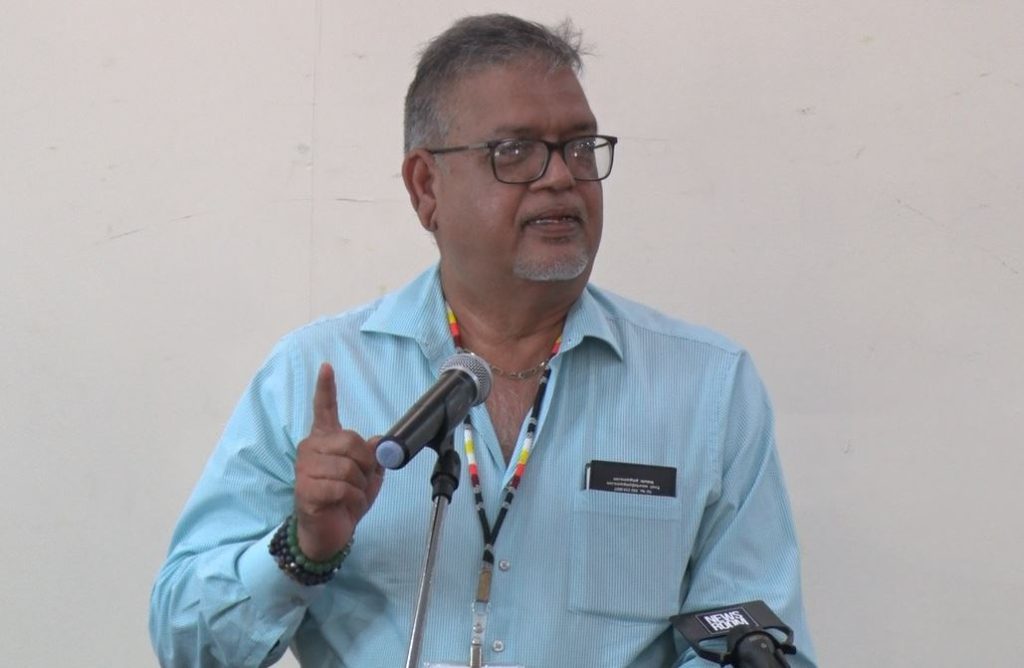

Ramesh Dookhoo, the Chairman of the Trade, Investment & Legal Committee of the Guyana Manufacturing Services Association (GMSA), on Friday, echoed similar concerns.

He told the News Room that this impact will affect every person, both producers and consumers, who use glass packages. It will further impact the already high cost of living.

“There’s a tariff issued if you import goods extra-regionally that you have to pay so those companies will have to pay, which will take the price of soft drinks, beer, rum vodka, everything that DDL makes and everything that Banks makes, and it will take the price up,” Dookhoo explained.

He added, “The position of the Manufacturing Association of Guyana is that this is an unreasonable request and should not be entertained at all. It’s a very damaging thing to the local beverage and rum industry in Guyana.”

Tariff barriers are taxes imposed by the government on the import and export of goods. Under the Customs Act, Guyana levies a GY $10 environmental tax on every unit of non-returnable metal, plastic, glass, or cardboard container of any alcoholic or non-alcoholic beverage imported into the country.

According to the CPSO, by imposing these taxes, the regional glass producers can benefit but Dookhoo said the intent would only benefit one company. The Carib Glassworks Limited, owned by ANSA McAl is a glass-producing company in the Caribbean that already receives business from the region. However, it has had its fair share of complaints as it relates to supply and quality.

Dookhoo said the company wants to expand.

“The point here is that you cannot create preconditions. If Carib Glass wants to expand and be able to satisfy the Caribbean market, that’s fine…Now, for you to ask that a CET (Common External Tariff) be imposed on extra-regional glass, it means you have to have a Caribbean supplier that can satisfy the market both in quality and quantity and this is not so,” he said.

In the meantime, Dookhoo noted that the GMSA will soon meet to further discuss the issue and the impact it will have on Guyana’s economy.

Time to go into manufacturing and production of food production packaging and increase the competition for such items. this would cover all type of packing that require glass. When a company which feel it has a monopoly on any item can unilaterally set the price as they deem fit for their profit margin and really care little about the ripple effect on the commodities that utilize their product/s. This is where inflationary spiral starts. There has to be ‘push back’ on such behaviour.