With the aid of technology, Demerara Bank’s loans and advances soars to $95.36 billion, accounting for 38% of banking sector lending over the last twelve (12) months.

The bank also maintained its exemplary record of zero non-performing loans.

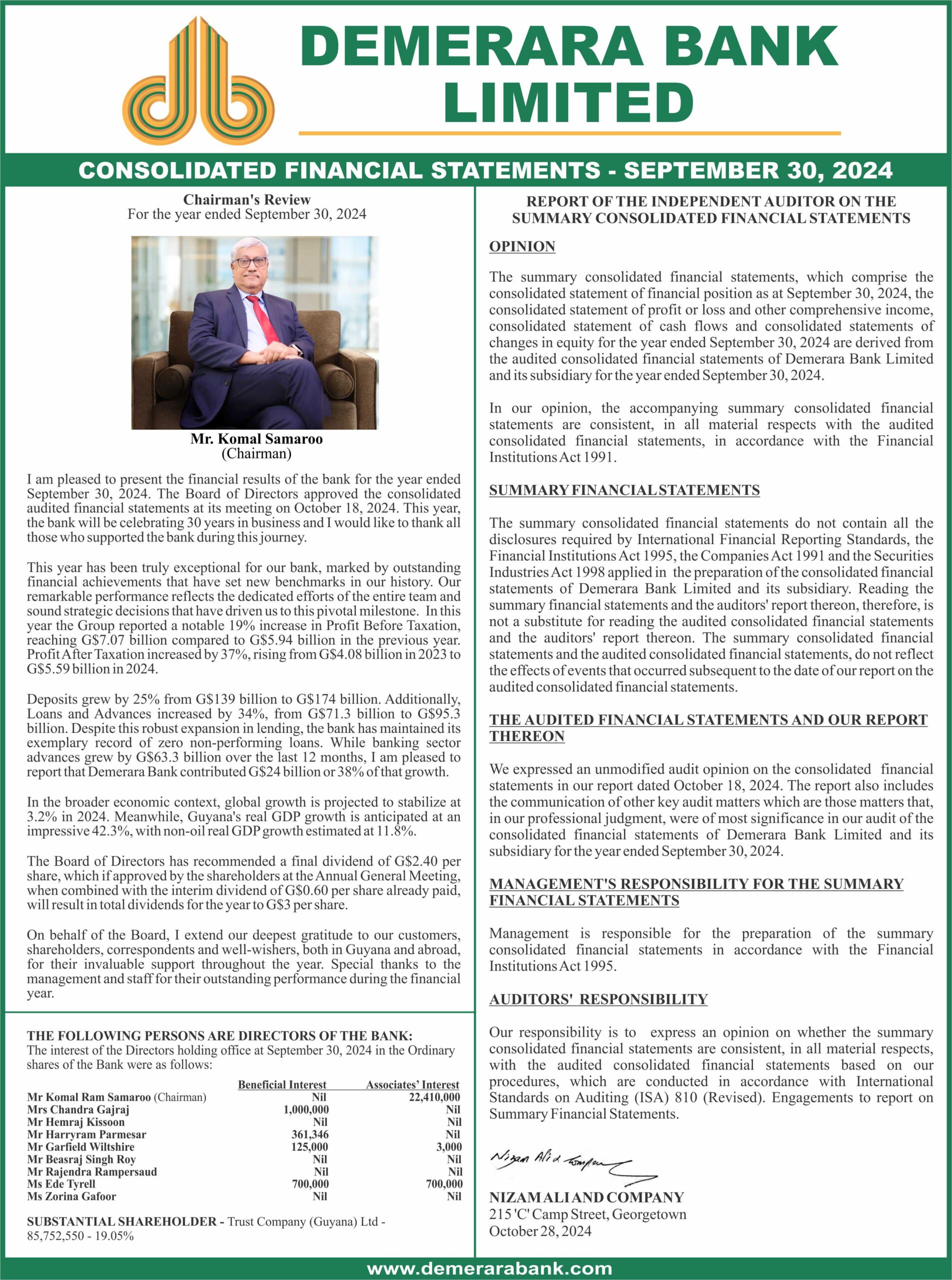

See below the full statement issued:

Demerara Bank Limited (DBL) announced its consolidated financial performance for the year ended September 30, 2024, delivering exceptional growth across all financial indicators, with significant contributions to lending and support for key sectors of Guyana’s economic development. The bank reported a 34% increase in loans and advances, rising from G$71.37 billion in 2023 to G$95.36 billion in 2024. This growth reflects DBL’s strategic efforts to diversify its lending portfolio, with notable expansions in agriculture, real estate, SME’s and services, all supporting the growing Guyanese economy. While driving sectoral growth, the bank maintained zero non-performing loans for the third consecutive year, underscoring disciplined credit management. Accounting for 38% of the total increase in industry-wide lending, DBL reinforced its role as a major contributor to Guyana’s economic progress. This milestone year was also marked by strategic investments in customer centered technology, disciplined risk management and continued commitment to modern, customer-focused solutions. Enhanced technological infrastructure further underscored DBL’s mission of economic empowerment and innovation.

The Bank has planned a series of transformational technological roll-out within the next few months that will improve customer experience. These rollouts will soon be announced to the public.

Key Financial Highlights:

- Net Profit Growth: Net profit increased by 37% to G$5.59 billion, up from G$4.08 billion in 2023.

- Earnings Per Share: Earnings per share improved by 37% to $12.42, up from G$9.06 in 2023.

- Deposit Expansion: Total deposits surged by 25% to G$174.56 billion as of September 30, 2024, driven by a 29% growth in savings deposits, which rose from G$79.4 billion in 2023 to G$102.4 billion. Deposit growth within the banking sector [all commercial banks] increased by 19%.

- Return on Average Assets: The Return on Average Assets increased to 3.1%, exceeding the industry average of 2.11%

- Market Share of Banking Assets: This increased by 22% over the last five years.

- Loan Growth: Demerara Bank Ltd. recorded a 34% increase in total loans and advances, increasing from G$71.37 billion in 2023 to G$95.36 billion in 2024 against banking sector growth of only 17%.

- Sectoral Diversification: Lending in key sectors in 2024 included residential / commercial real estate, consumer financing, services, SME’s & Agriculture and other important sectors, reflecting the banks strategic focus on diverse economic support.

- Zero Non-Performing Loans: For the third consecutive year, Demerara Bank Ltd. maintained zero non-performing loans, underlining its disciplined credit management practices.

- Enhanced Capital Adequacy: The capital adequacy ratio rose to 23.53%, exceeding the industry average of 18.11% and the regulatory benchmark of 8%.

- Robust Asset Growth: Total assets expanded by 27% to G$202.23 billion, highlighting the bank’s robust financial health and capacity for future growth.

Looking ahead

As Demerara Bank Ltd. enters its 30th year, it remains focused on sustainable growth, technological innovation and meaningful community engagement. The bank is committed to further enhancing shareholder value while meeting the evolving needs of its customers.

The CEO, Mr. Dowlat Parbhu, articulated the bank’s enduring promise “We have always aimed to build a bank that offers modern, customer-focused financial solutions while adhering to the highest standards of trust, transparency, and stability.” He expressed gratitude to his team for their hard work and commitment, as well as appreciation for the trust placed in them by their customers and the ongoing support from shareholders.

Chairman, Mr. Samaroo acknowledged this year’s success, attributing it to strategic foresight and the dedication of the Demerara Bank Limited team, stating “Our results this year reflect our ongoing commitment to excellence, innovation and economic empowerment for the people of Guyana.”