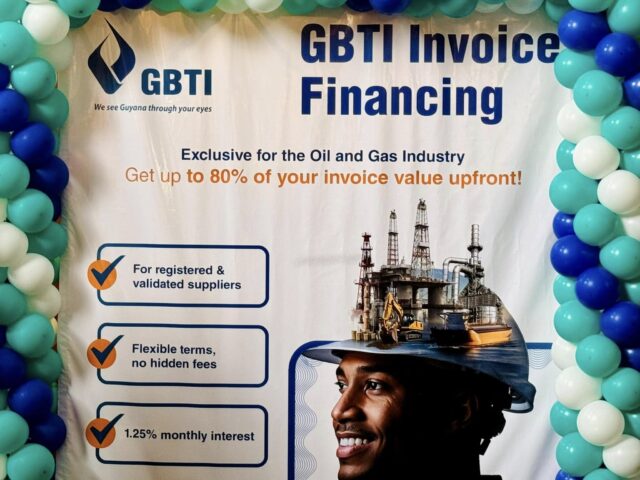

The Guyana Bank for Trade and Industry (GBTI) on Friday launched its Invoice Financing – a short-term working capital solution that gives businesses immediate access to cash by advancing up to 80 per cent of their validated invoice value, thus helping to bridge the gap while awaiting payment.

Registered suppliers with a proven track record in the oil and gas sector can apply, along with suppliers with validated invoices from Esso Exploration and Production Guyana Limited (EEPGL) or prime contractors.

A ceremony to mark the official launch was held at GBTI in Kingston where an overview of the new product was given, along with some of its benefits such as fast cash flow, flexible terms, a competitive rate, no hidden fees and a simple process.

According to Chief Commercial Officer Rawattie Mohandeo, under this programme, suppliers can now access short-term working capital, using their invoices as collateral.

This structure can empower businesses with the liquidity they need to grow, ensuring that financial bottlenecks no longer hinder progress.

“This initiative…aligns seamlessly with both GBTI and ExxonMobil’s broader vision for Guyana, which is to create greater accessibility to finance for local businesses, enabling them to participate more actively in the country’s growing economy,” Mohandeo shared.

The bank, according to her, is actively looking to expand this reach with other tier one contractors in the oil and gas sector, as well as to expand the network of available partners.

“We have long understood the challenges faced by local suppliers in securing working capital to meet contract obligations. Over the past few years, we have been diligently exploring ways to bridge this gap,” she said.

Finance Minister Dr Ashni Singh said the bank should be highly commended for putting this structure in place.

“I want to urge you, as I know is your intention, to move in the shortest possible time to do the same in relation to tier one contractors and to consider extending similar facilities even to sectors outside of oil and gas.”

Dr Singh called attention to the astronomical expansion that is ongoing in the private sector and the role that GBTI, a local bank, is playing in this.

To put things in perspective, he pointed out that at the end of 2020, the total credit to the private sector was in the vicinity of $260B, but by the end of 2024, the figure rose to some $450B.

“I want to congratulate… the management of GBTI for pushing the envelope, for delivering something today that the private sector has been clamoring for, for a long time; for giving them a product now that they’ve been calling for, making that product available and expressing the intention to expand the availability of that product,” Dr Singh expressed.

Meanwhile, also present at the ceremony were Chief Executive Officer of GBTI Shawn Gurcharran, Chairman of the Beharry Group of Companies Suresh Beharry, Chairman of the Private Sector Commission (PSC) Komal Singh, and former PSC Chairman Manniram Prashad.