BY Correspondent

Access to concessionary resources is becoming more difficult. And with this stark reality in mind, it can be seen as quite impressive that Guyana has been able to secure membership with the Islamic Development Bank (IDB).

This information was transmitted via an official correspondence to the Government of Guyana in late March 2016.

This is a signal development as Guyana has been attempting to join the Bank ever since it became a member of the Organization of Islamic Conference (OIC) in 1998. This is the second largest inter-governmental organisation after the United Nations which has membership of 57 states spread over four continents.

Among its main objectives, the OIC aims to promote respect for the right of self-determination and non-interference in the domestic affairs and to respect sovereignty, independence and territorial integrity of each of its Member State and develop science and technology and encourage research and cooperation among its members.

Joining this bank’s class of premium members is a prerequisite to joining the membership of the IDB.

This opportunity will afford Guyana an alternative source of financing to highly concessional resources including grants and interest free loans. It is expected that membership will also greatly assist in financing the Government’s development agenda; redounding to the ‘good life’ for all citizens.

The areas of intervention of the IDB include human development, rural development and food safety, infrastructural development, trade among member countries and private sector development, research and development in Islamic economies and banking and finance.

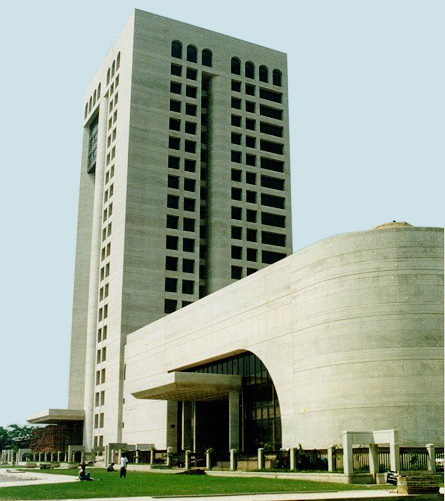

The IDB was established in December 1973 and officially opened its doors for business on October 20, 1975, with Headquarters in the Kingdom of Saudi Arabia. It also operates through regional offices in Kazakhstan, Senegal, Malaysia and the Kingdom of Morocco.

The Bank was established with the purpose of fostering economic development and social progress in member countries and Muslim communities. The IDB currently has a membership of 56 countries in Latin America (1); African (27); Europe (2) and Asia (26). Guyana joins as the 57th member.

Suriname is the other CARICOM Member State that is a member. The functions of the Bank are to participate in equity capital and grant loans for productive projects and enterprises besides providing financial assistance to member countries in other forms for economic and social development.

The Bank is also required to establish and operate special funds for specific purposes including a fund for assistance to Muslim communities in non-member countries, in addition to setting up trust funds. The Bank is authorized to accept deposits and to mobilize financial resources through Shari’ah compatible modes.

It is also charged with the responsibility of assisting in the promotion of foreign trade especially in capital goods, among member countries; providing technical assistance to member countries; and extending training facilities for personnel engaged in development activities in Muslim countries to conform to the Shari’ah.

The basic condition for membership is that the prospective member country should be a member of the Organisation of Islamic Cooperation (OIC), pay its contribution to the capital of the Bank and be willing to accept such terms and conditions as may be decided upon by the IDB Board of Governors.

As per the decision of the 38th Annual Meeting of the Board of Governors, the authorized capital of the IDB was raised to ID 100 billion and its subscribed capital to ID 50 billion.

By its charter, the Islamic Development Bank is mandated to foster socioeconomic development of its member countries and Muslim communities in non-member countries, in accordance with the principles of Shariah (Islamic Law). Since its establishment, membership in the institution has grown considerably and there has been several increases in its capital side by side with the demand for more resources from member countries to finance operations.

For over a decade now, IDB is rated AAA by the three major Rating Agencies (Standard & Poor’s, Moody’s, and Fitch), facilitating mobilization of resources from the market to meet the rising financing requirements from member countries.

It is this rising demand from stakeholders combined with the strategic challenges facing the Muslim world that led the IDB to realign its priorities and shape a new mission and vision for the institution in accordance with new world realities.

As a result, during 2005, the IDB initiated a landmark public consultation with the stakeholders leading to the development of a shared long-term vision for the Bank which could further complement and instill a long-term sense of direction to its future activities as well as provide better service to the stakeholders.

Last year, President David Granger, visited Riyadh, Saudi Arabia and described Guyana’s participation at the Fourth Summit of the Arab and South American Countries (ASPA) as fruitful and a success.

He said that it was an important forum for Guyana to advance its interest with some of the major states in the Arab world and South America.

On the sidelines of the summit, the President and his delegation held a meeting with the Secretary General of the Organisation of Islamic Cooperation, Iyad Ameen Madani.

In October of last year as well, Granger also met with the bank’s senior economist, Dr. Salman Syed Ali, and its Division Manager of Advisory Services, Yahya Aleem ur Rehman, where he was updated on the bank’s activities in the region and discussions were held on Guyana’s potential for financing.